- Home

- Sustainability

- Governance

- Risk Management

Risk Management

Approach to Risk Management

To ensure business continuity and maintain a stable management base, we have positioned risk management as a management priority and are promoting relevant initiatives. The risks a company faces are becoming increasingly diverse and complex. If any of these serious risks materialize, not only could the group’s management resources be damaged, but there may be harmful consequences for business continuity. This could include damage to the relationships of trust built with customers and business partners, as well as loss of social credibility. To respond to these risks, we have established a system to identify the possibility and potential impact of the occurrence of such risks and to ensure the implementation of measures to prevent the manifestation of such risks. We have also put measures in place to deal with such risks in the event that they do materialize.

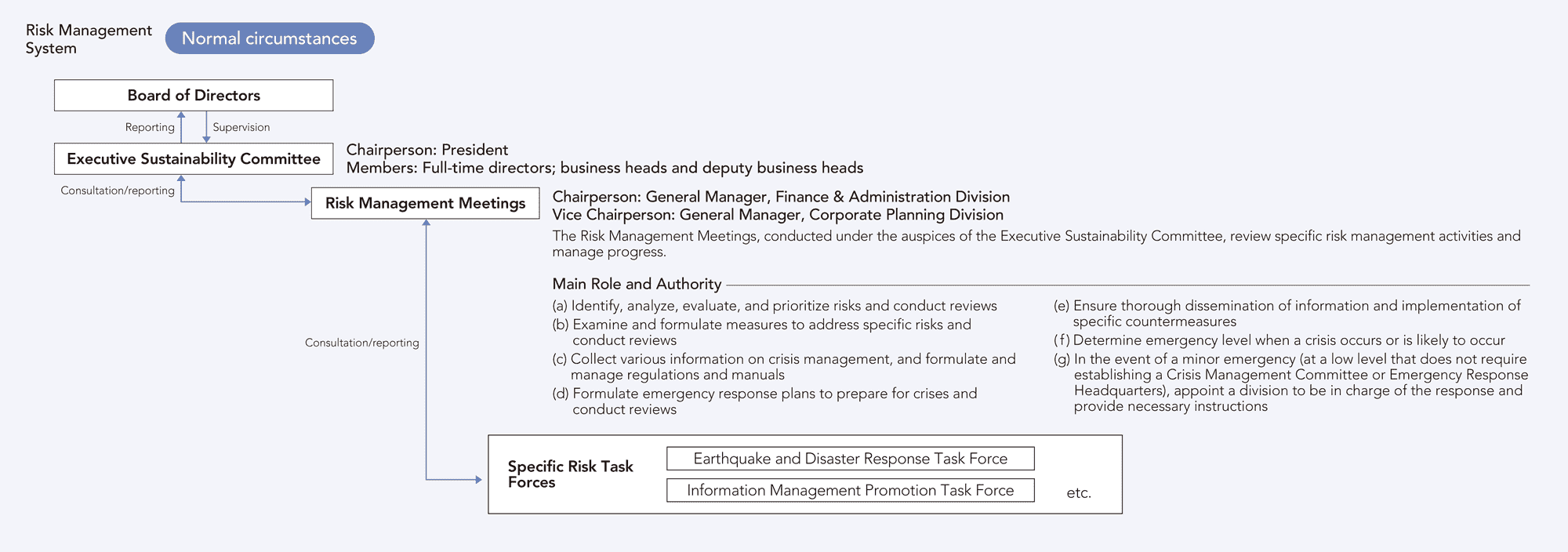

Risk Management System

Members of the Executive Sustainability Committee discuss and approve annual activity plans related to risk management and confirm the progress of these plans on a quarterly basis. The committee also reports to the Board of Directors, which supervises these activities. The Risk Management Meetings, under the auspices of the Executive Sustainability Committee, are chaired by the general manager of the Finance & Administration Division, and members identify, analyze, evaluate, and prioritize risks as well as formulate measures to address specific risks.

Business Risks

Risks that could significantly influence the decisions of investors regarding the group are as follows. Items marked with a ★ are those deemed to require particularly significant measures based on the results of risk assessments.

| Risks | Segment impacted | ||||||

|---|---|---|---|---|---|---|---|

| Classification | Subclassification | Details | Japan Wholesaling |

Non-Japan Wholesaling |

Paper Manufacturing & Processing | Raw Materials & Environment | Real Estate Leasing |

| Particularly significant risks | Market conditions and market risks | Risks related to a decrease in demand for main products handled, market conditions, and macroeconomic fluctuations | ● | ● | ● | ● | |

| Impact of real estate market conditions | ● | ||||||

| Risks related to business transactions | Credit risks of business partners | ● | ● | ● | ● | ● | |

| Risks of policy changes at supplier manufacturers | ● | ● | |||||

| Other significant risks | Risks related to decline in paper distributor function | ● | ● | ||||

| Risks related to logistics | ● | ● | ● | ● | |||

| Risks related to new business investments | ● | ● | ● | ● | |||

| Impairment risk for stocks of subsidiaries and affiliates and impairment risk of goodwill | ● | ● | ● | ● | |||

| Impairment risk of property, plant, and equipment | ● | ● | ● | ● | ● | ||

| Other risks | Risks related to business environment | Legal and regulatory restrictions | ● | ● | ● | ● | ● |

| Country risk | ● | ● | ● | ||||

| Risks related to financial markets | Risks related to financing | ● | ● | ● | ● | ● | |

| Risks related to foreign exchange rate fluctuations | ● | ● | ● | ● | |||

| Risks related to climate change, natural disasters, etc. | Risks related to climate change and natural disasters, etc.★ | ● | ● | ● | ● | ● | |

| Other risks | Risks of fluctuation in value of investment securities held | ● | ● | ● | ● | ● | |

| Risks related to IT and security | ● | ● | ● | ● | ● | ||

| Risks related to litigation | ● | ● | ● | ● | ● | ||

| Human resource and labor-related risks★ | ● | ● | ● | ● | ● | ||

| Risks related to human rights issues* | ● | ● | ● | ● | ● | ||

| Risks related to recoverability of deferred tax assets | ● | ● | ● | ● | ● | ||

- Response to risks related to human rights issues: The group is responding to business and human rights issues as part of its sustainable management initiatives. In fiscal 2024, we conducted training for executives and employees at Japan Pulp & Paper as well as at all group companies, and we also performed human rights due diligence to identify important human rights issues at the group from such perspectives as severity and likelihood of occurrence. At the same time, we assessed the risk of human rights violations at our main suppliers.

[Related link]

Initiatives to Enhance Risk Management

We conduct risk assessments with the aim of identifying risks that are important from both a group-wide and medium-to-long-term perspective, and in terms of enhancing future risk countermeasures. In our risk assessments, we have established approximately 130 evaluation items to comprehensively identify various risks. We assess risk based on two axes (impact and likelihood of occurrence) and consider the level of measures in place at the time of the assessment in order to identify priority issues.

The secretariat of the Risk Management Meetings conducted a risk assessment of Japan Pulp & Paper and all group companies in and outside of Japan between the end of fiscal 2023 and the first half of fiscal 2024. An analysis of the responses indicated the need to review and strengthen measures for risks related to natural disasters as well as human resource and labor-related risks, which were recognized as a shared challenge for the group. In addition, although not included in the aforementioned list of business risks, we reconfirmed that measures to ensure the safety of executives and employees residing outside of Japan and to respond to accidents at facilities were insufficient.

Based on these results, the Executive Sustainability Committee has decided on a final list of significant risks and implemented measures to address them, starting from those with the highest priority.

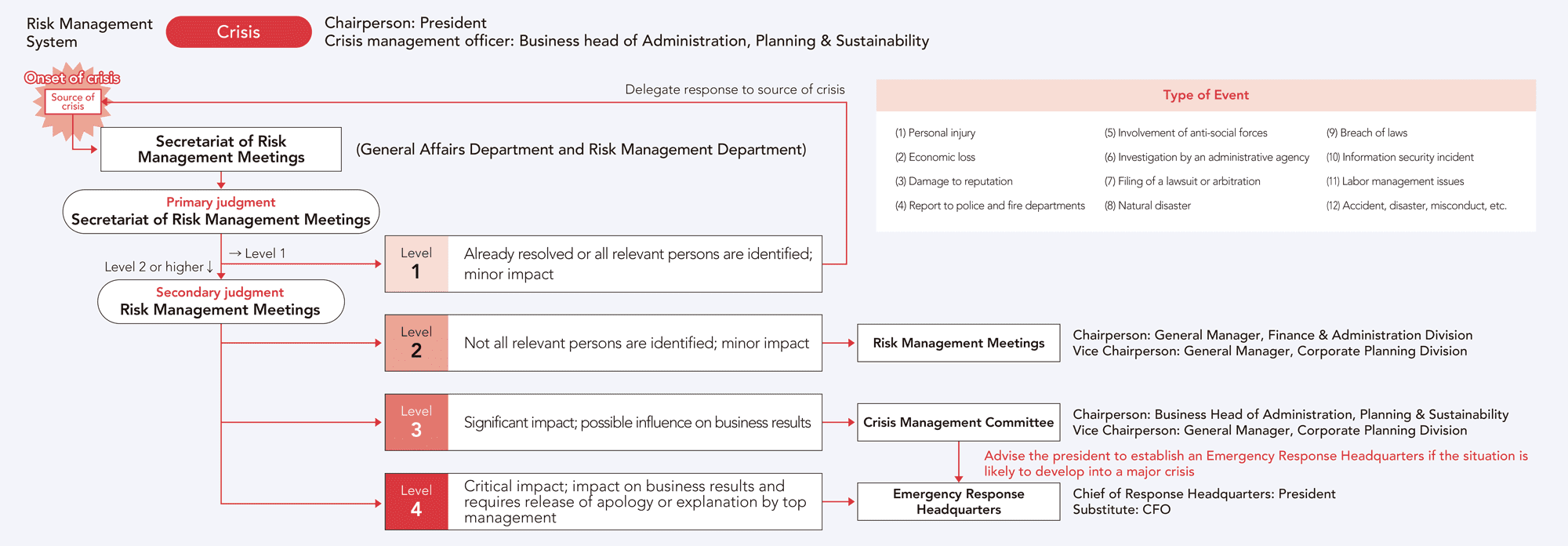

Crisis Response Structure

In the event that a risk with a significant negative impact on the group’s management or business materializes, a Crisis Management Committee, with ultimate responsibility held by the president and chaired by the business head of Administration, Planning & Sustainability, will be established. The committee will be tasked with rapidly and appropriately dealing with the emergency situation, minimizing or preventing damage, restoring normalcy, and putting countermeasures in place.